Vehicle liability insurance: Automatic extension of coverage, and withdrawal of an insurer’s licence to conduct insurance activity

On 16 April 2025 the Polish Financial Supervision Authority banned the Bulgarian company Insurance JSC DallBogg: Life and Health from offering mandatory civil-liability coverage for operators of motor vehicles in Poland. The decision was issued under the rarely-used procedure of Art. 214(5) and (4a) of the Insurance and Reinsurance Act of 11 September 2015.

The example of the Sofia-based insurer is particularly interesting because it presents an “urgent case,” i.e. an extraordinary situation based on relatively vague grounds. As stated in Art. 214 of the Insurance and Reinsurance Act, “To promptly eliminate or prevent the occurrence of further irregularities, in an urgent case the supervisory authority may apply to a foreign insurance company, as relevant, all of the entitlements it holds under the act in relation to domestic insurance companies, apart from the procedure referred to in par. 2–4. As part of its activities, the supervisory authority may also prohibit activity in the territory of the Republic of Poland by a foreign insurance company.”

But leaving aside the procedure, the communiqué from the Polish Financial Supervision Authority (KNF) clearly indicated that as a result of the KNF decision, DallBogg can no longer conclude new mandatory civil liability policies in Poland, and the current policies will not be automatically extended after the end of their term. The lack of a valid liability policy can have serious consequences, and thus this unusual incident provides a good occasion to review the reasons and the rules for operation of the mechanism of automatic extension of such policies.

Due to the high individual and social risks associated with motor vehicle traffic, the system of mandatory civil liability insurance for motorists in Poland was designed to ensure continuity of coverage both for drivers and for potential victims of traffic accidents. To this end, it is vital to avoid interruptions in the period of insurance coverage for specific vehicles. Thus the parliament adopted the solution that once a mandatory civil liability policy for motorists is in force, as a rule it will be automatically extended, except in certain instances set forth in the act.

The automatic extension of motor vehicle civil liability policies does not apply to short-term insurance contracts or contracts individually negotiated by businesses. A policy will also not be automatically extended when the policy has passed from the seller to the buyer as a result of sale of the vehicle. In all other cases, if the holder of the vehicle does not submit a written notice of termination up to one day before the end of the 12-month term of the old policy, a new policy is deemed to be automatically concluded with the same insurer for a further 12 months.

Automatic extension of a mandatory motor vehicle liability policy means that the insurance protection begins immediately, even if the policyholder has not yet paid the premium under the new policy or the first instalment. The policy will be valid through the end of the new 12-month insurance term, and in the event of a traffic accident the injured party will receive compensation under the policy. However, the insurer has a claim for payment of the premium and may charge interest on delay in payment.

So that the insured may make an informed decision on continuation of coverage with the existing insurer, the insurance company must notify the insured at least 14 days before the end of the 12-month period of the old policy of the terms under which the coverage will be extended if the insured does not decide to terminate the contract.

This notice must include:

- The proposed premium for the next term of the insurance

- A notice that the premium may be subject to change if new circumstances arise after the notice is sent which could affect the amount of the premium, with an indication of these circumstances

- Information on the right to terminate the contract and the form and deadline for submitting a notice of termination

- Information on the consequences of termination of the contract and the consequences of failure to terminate the contract.

Despite failure to terminate the old contract, a new contract will not be automatically concluded in the following instances:

- If the premium for the preceding 12-month term was not paid in full

- If the insurer’s licence to conduct insurance activity involving motor vehicle civil liability coverage has been withdrawn

- If bankruptcy or liquidation proceedings have been commenced against the insurance company, or a bankruptcy petition has been dismissed due to insufficient assets to cover the costs of the bankruptcy proceeding.

For their part, motor vehicle owners who wish to automatically extend their coverage should make sure they have paid the premium under the old policy in full before the end of the term of the insurance. And if they receive signals of concern, they also follow the KNF announcements of oversight measures applied against insurance companies.

However, it should be pointed out that withdrawal of the insurer’s licence to offer motor vehicle liability policies, as well as commencement of bankruptcy or liquidation proceedings, does not affect the validity of contracts that have not yet expired. These contracts remain in force, and the insurance will expire only at the end of the term specified in the contract. This works differently if the insurance company is declared bankrupt. Then, if the receiver does not reach an agreement to transfer the portfolio of policies to another insurer, mandatory motor vehicle civil liability insurance contracts concluded by an insurer that has been declared bankrupt are dissolved three months after the insurer is declared bankrupt.

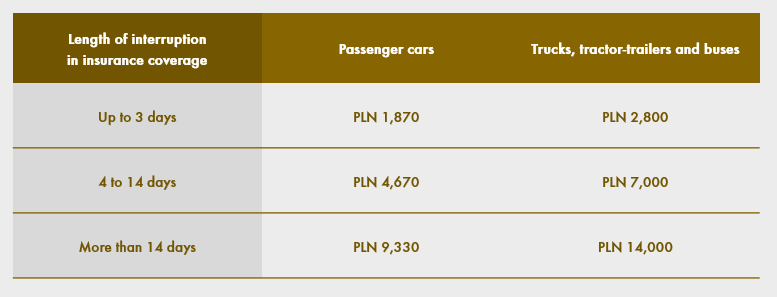

Significantly, interruptions in the continuity of insurance coverage may lead to imposition of high fees by the Insurance Guarantee Fund.

There is no one fixed fee for lack of a mandatory policy, but the fee depends on three factors:

- The current minimum wage

- The type of vehicle

- The length of the interruption in insurance coverage.

The level of the fees as of the first half of 2025 is as follows:

Thus, regardless of whether the motorist decides to automatically extend the contract with the current insurer, or to change insurers, it is important to make sure that the formalities connected with conclusion of a new liability policy are completed before the old insurance coverage expires.

Mateusz Kosiorowski, adwokat, Anna Szczęsna, Insurance practice, Wardyński & Partners