Not all public assistance is state aid

Granting of state support in the EU, which businesses are increasingly taking advantage of, is based on a set of common principles. Mainly these include compatibility with the internal market, achievement of an objective of common interest, a clear incentive effect, proportionality, and full transparency. Violation of these rules when granting public support may mean a grant of unlawful state aid, incompatible with the common market and subject to recovery.

Progress on the Polish National Recovery Plan and amendments to state aid law

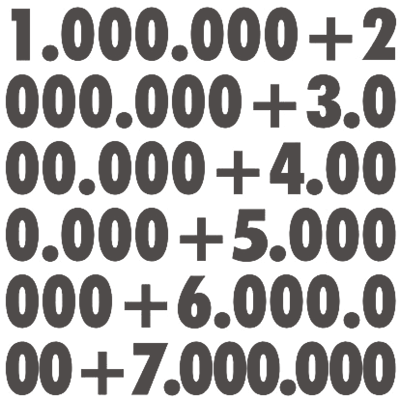

On 3 May 2024, Poland marked the third anniversary of submission of the first version of its National Recovery Plan to the European Commission. On the eve of that date, information was released on disbursement of the first funds under the plan, in the amount of c. EUR 6.3 billion. But this is not the only good news for those interested in financial support from European funds. Legislative work is also underway to help absorb funds the National Recovery Plan and other European funds.

SMEs do not lose their status automatically

In 2020, the EU’s General Court held in T-745/17, Kerkosand v Commission, that SME status is determined based on three criteria verifiable in two successive accounting periods (known as the “two accounting years rule”). It has been four years since the General Court issued this ruling, but the authorities acting as intermediate or managing institutions under EU programmes, as well as national administrative courts (albeit with commendable exceptions), continue to take the position that changes in a beneficiary’s corporate ownership structure (acquisition of a majority of its shares) result in automatic loss of SME status on the date of the change.

Amendments to the Strategic Investment Programme for 2011–2030

The Council of Ministers has adopted an amendment to the Programme for Supporting Investments of Strategic Importance to the Polish Economy for 2011–2030, under Resolution 91/2023 of 5 June 2023. The changes will be in effect until the end of the support period (2025).

The European Commission may now investigate subsidies from third countries

Starting 12 July 2023, the European Commission can initiate investigations into financial support granted to undertakings by countries outside the European Union, pursuant to the Foreign Subsidies Regulation (FSR). The purpose of the regulation is to combat distortions in the EU single market caused by foreign subsidies, while keeping the EU open to trade and investment.

Court of Justice will assess whether the exemption of rail infrastructure from property tax is state aid

Rail infrastructure and the land on which it is located are exempt from property tax in Poland. Is that unauthorised state aid? The answer from the Court of Justice could have far-reaching consequences.

Subsidised electricity prices for SMEs, i.e. for whom?

High energy prices are greatly impacting economies around the world. Recognising the state of crisis, the European Union is introducing a number of amendments to the law to mitigate the effects of high electricity prices. In Poland, support instruments are governed by the Electricity Price Act and are intended to benefit electricity end users such as households and SMEs. Thus for companies it is crucial to assess their own size.

EU funds in the 2021–2027 financial perspective and the automotive sector

Poland will be the biggest beneficiary of the upcoming European Union financial perspective for 2021–2027. The two main objectives for funding in the new financial perspective, i.e. Smart Europe and Green Europe, are in line with the objectives of the modern automotive sector. Therefore, its players can count on solid support.

SME status and the Financial Shield of the Polish Development Fund

The Financial Shield of the Polish Development Fund (PFR) is one of the most popular support instruments launched in relation to the coronavirus epidemic. Aid under the programme is differentiated and depends on the classification of the beneficiary as an SME (micro, small or medium-sized enterprise) or a large enterprise. So determining the size of the enterprise is crucial for assessing the potential benefits. Another difficulty is the change in eligibility conditions for SMEs introduced by the fund, which may affect the situation of entities considering applying for subsidies and those who have already received them. Some recipients may have to repay the aid.

Tax law and state aid

The basic tool for determining whether there is a grant of state aid is Art. 107 of the Treaty on the Functioning of the European Union. One of the ways a member state may be found to violate state aid rules is through its tax laws.

State aid in a special economic zone—benefits but also obligations

Classification of an income tax exemption as state aid entails a number of consequences extending far beyond tax issues.

Uncertain future of support for industrial electricity customers

The Energy Law is to permit industrial users to obtain certificates of origin and present them for redemption for only a portion of the electricity they purchase. But the future of this support mechanism has been called into question.